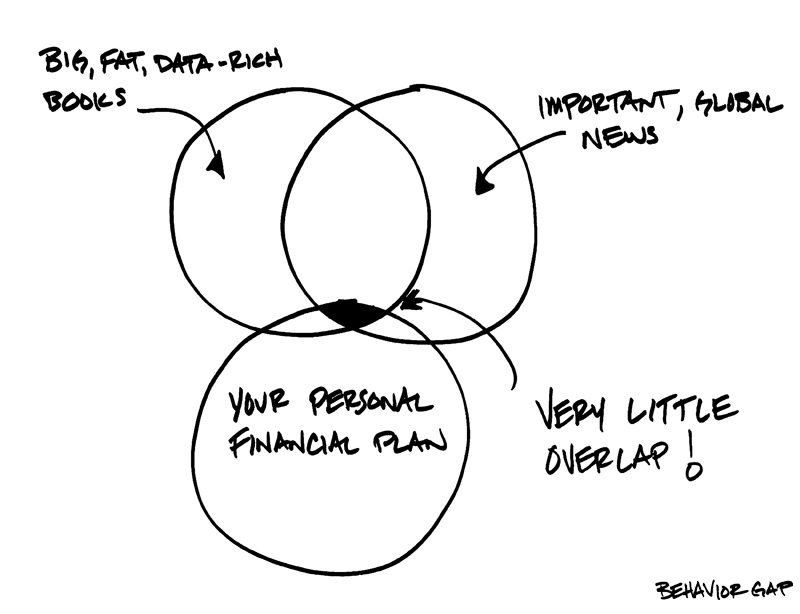

Here we are at session number 110, and we’re going to be talking to a US financial planner called Carl Richards about his new book, The One-Page Financial Plan. You know I’m always banging on about planning here on the podcast, and Carl’s book distills the idea of financial planning down to the basics. Carl has a knack of explaining financial planning and particularly behavioural finance concepts in an easy-to-understand way through a series of sketches that he draws. These sketches are peppered throughout the book and also on his website, behaviorgap.com. Stay tuned for my chat with Carl, and scroll to the bottom of this post to learn of a competition to pick up one of Carls books!

Podcast: Subscribe in iTunes | Play in new window | Download

If this show is of any use to you, it would help me massively if you would take the time to leave me a review on iTunes. This has a huge impact on keeping me near the top of the rankings, which in turns helps more people to find the show and to subscribe. I’ll remind you again at the end of the show, but if you want to do it right now, just click the button below:

Sponsor Message

This podcast is brought to you with the help of Seven Investment Management, a firm of investment managers based in London. They specialise in multi-asset investing, bringing institutional investing techniques to ordinary people like you and me. 7IM put their name to my show and to my site because they believe in what I’m doing, trying to get decent, easy-to-understand financial information out to the world. I’m very grateful to them for their support.

This podcast is brought to you with the help of Seven Investment Management, a firm of investment managers based in London. They specialise in multi-asset investing, bringing institutional investing techniques to ordinary people like you and me. 7IM put their name to my show and to my site because they believe in what I’m doing, trying to get decent, easy-to-understand financial information out to the world. I’m very grateful to them for their support.

You can see what they’re up to at 7im.co.uk

Introduction

Here are the questions I put to Carl:

- Can you tell us who you are, what you do and how you got to this point?

- I love the title of your book – The One-Page Financial Plan – can you tell us what the inspiration was behind the book?

- We share a passion for making financial matters simple enough for people to digest and take action on, without dumbing-down. Do you think that this kind of education is important? What is the state of financial literacy in the US?

- I've been thinking a lot recently about what a financial plan actually is. Can you elaborate about what you think should be on there, and how that differs from what sometimes we as advisers think should be?

- I love your series of ‘Let Go's' on pages 69-71 – I think they really empower people to make good decisions – can we cover them quickly?

- You have a very clear trajectory in the book, like a good story arc in a TV series. You start by encouraging us to get clear about where we are currently. Why do you think that is important?

- The chapter on budgeting is entitled Budgeting as a tool for awareness. The fact that budgeting is about looking forward not tracking what has happened was a revelation to me several years ago. Why do you think this simple fact evades so many people?

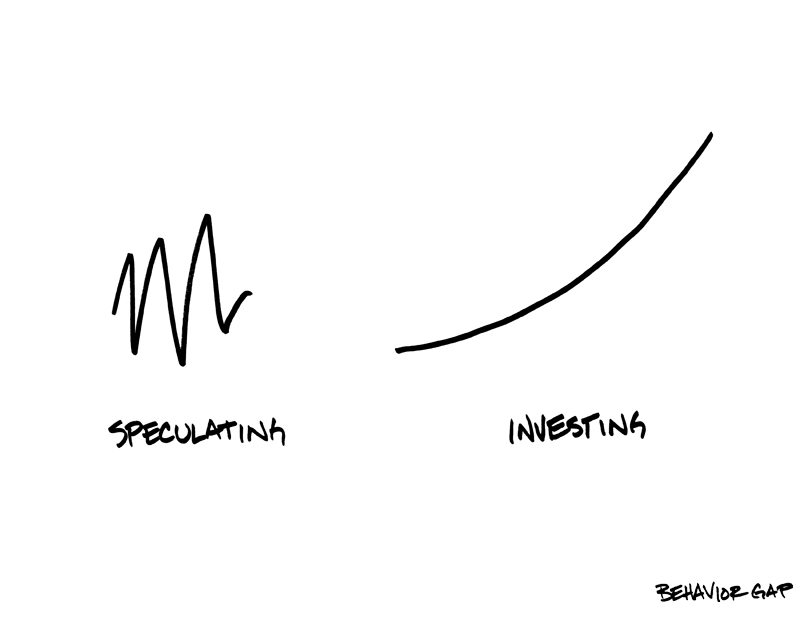

- You obviously cover the basics of investing in the book, things like portfolio diversification and rebalancing. But then you cover the important aspect of what could be called behavioural finance. Do you have any examples of where smart/unwise investor behaviour has led to good/suboptimal outcomes?

- I also (predictably) like the exhortation to find a real financial adviser. Can you explain what you think that looks like?

- Finally, where can people go to find out more about you, and the book?

Don’t forget, a full transcript of this entire episode is available if you hit the button below:

Resources

The One-Page Financial Plan on Amazon (Affiliate link)

The Behavior Gap, Carl’s website

Carl Richards on Twitter

Competition

To win a copy of Carl’s new book (I have three copies to give away) just leave me a review and tell me what you enjoyed about the conversation and what subject(s) you would like me to cover on the podcast in the near future…

Reviews

Big thanks to KDK21 for their review this week.

Don’t forget to go to meaningfulmoney.tv/iTunes or hit the big red button below to leave a review – it really helps!

Next Session Announcement

Next time I’ll be returning to the Investment Masterclass, and look at setting targets.

If you have any financial query that you want answering here on the show, then the best way to do that is to leave me a voicemail at meaningfulmoney.tv/askpete

Leave a Reply