Investing can be scary, not least because of the frequent use of words like risk and volatility. But these are just mechanisms to be explained and understood, just like anything else. If you understand them, you can harness them to your advantage. And that’s what I’m going to help you to do today.

Podcast: Subscribe in iTunes | Play in new window | Download

Sponsor Message

This podcast is brought to you with the help of Seven Investment Management, a firm of investment managers based in London. They specialise in multi-asset investing, bringing institutional investing techniques to ordinary people like you and me. 7IM put their name to my show and to my site because they believe in what I’m doing, trying to get decent, easy-to-understand financial information out to the world. I’m very grateful to them for their support.

This podcast is brought to you with the help of Seven Investment Management, a firm of investment managers based in London. They specialise in multi-asset investing, bringing institutional investing techniques to ordinary people like you and me. 7IM put their name to my show and to my site because they believe in what I’m doing, trying to get decent, easy-to-understand financial information out to the world. I’m very grateful to them for their support.

You can see what they’re up to at 7im.co.uk

Risk, Volatility and Timescale

Last week I said that one of the differences between saving and investing is risk. Money saved in a bank account is essentially risk-free. You know that the money will always be there, unless the bank itself goes under, which doesn’t happen that often. Investments, by contrast, have converted cash into real assets like shares, bonds, gold and property. Those things always carry an element of risk, and we need to understand how this works so that we can make the most of the opportunities which always accompany risk…

So, as usual, let’s look at what you need to KNOW first, then what you need to DO…

In this session, you'll discover:

- The four main risks when it comes to investing

- Why volatility is not the same as risk

- Why you should be very wary of averages

- Why timescale is a key factor when deciding risks

- How to smooth out risk (to some degree) with cost-averaging

- The three key methods for managing risk

Resources mentioned in this week's show

Podcast: Why Invest?

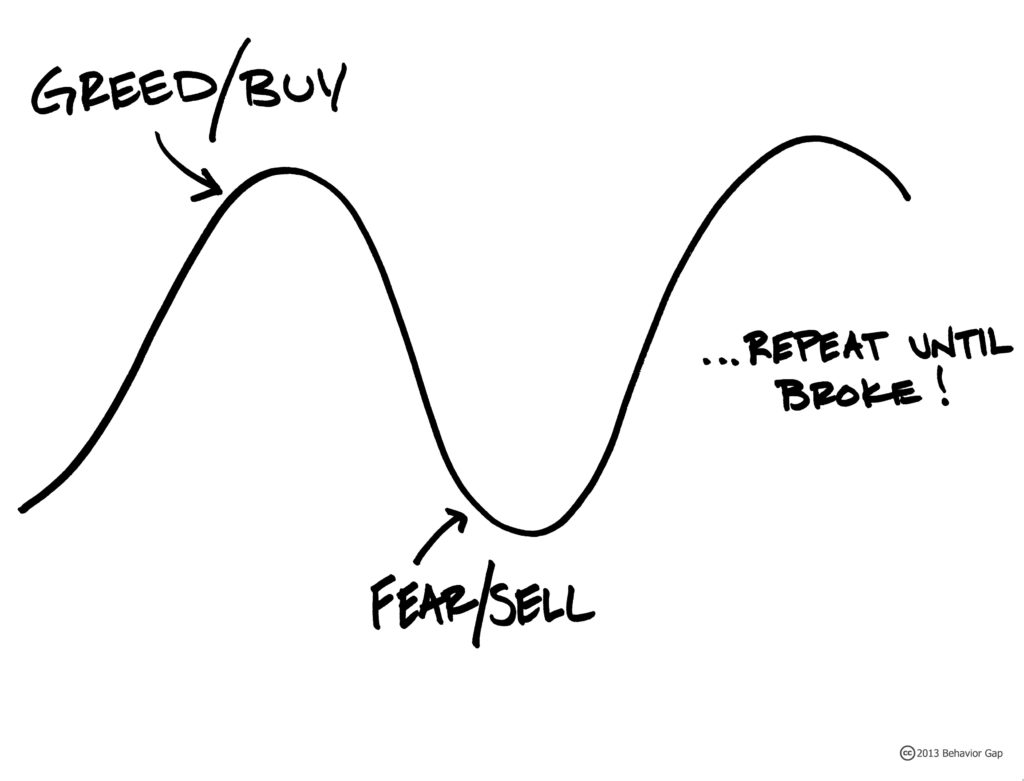

And here's the graphic from Carl Richards illustrating the futility of trying to time the market:

Free email course – Learn How To Invest

And of course, there is a full transcript available by clicking the big blue button below:

Join the conversation

I love to read and respond to your comments, so please do join in and share.

Question: Have you had any bad experiences when investing – what went wrong?

Share the love

If this show is of any use to you, it would help me massively if you would take the time to leave me a review on iTunes. This has a huge impact on keeping me near the top of the rankings, which in turns helps more people to find the show and to subscribe. Just click the button below:

Leave a Reply