Here we are at session number 105 , and we’re going to be talking about investing. Last year’s listener survey revealed that building an investment portfolio was the single biggest issue that respondents struggled with. Well, fear not! I am here to help with an investing masterclass! Over the next three or four weeks I’m going to be covering the art, nay, science of investing in enough detail that you should be able to build your own portfolio by the end of it. Or at least, you will know whether or not you want to embark on doing so or leave it to the professionals instead…

Here we are at session number 105 , and we’re going to be talking about investing. Last year’s listener survey revealed that building an investment portfolio was the single biggest issue that respondents struggled with. Well, fear not! I am here to help with an investing masterclass! Over the next three or four weeks I’m going to be covering the art, nay, science of investing in enough detail that you should be able to build your own portfolio by the end of it. Or at least, you will know whether or not you want to embark on doing so or leave it to the professionals instead…

Podcast: Subscribe in iTunes | Play in new window | Download

If this show is of any use to you, it would help me massively if you would take the time to leave me a review on iTunes. This has a huge impact on keeping me near the top of the rankings, which in turns helps more people to find the show and to subscribe. I’ll remind you again at the end of the show, but if you want to do it right now, just click the button below:

Sponsor Message

This podcast is brought to you with the help of Seven Investment Management, a firm of investment managers based in London. They specialise in multi-asset investing, bringing institutional investing techniques to ordinary people like you and me. 7IM put their name to my show and to my site because they believe in what I’m doing, trying to get decent, easy-to-understand financial information out to the world. I’m very grateful to them for their support.

This podcast is brought to you with the help of Seven Investment Management, a firm of investment managers based in London. They specialise in multi-asset investing, bringing institutional investing techniques to ordinary people like you and me. 7IM put their name to my show and to my site because they believe in what I’m doing, trying to get decent, easy-to-understand financial information out to the world. I’m very grateful to them for their support.

You can see what they’re up to at 7im.co.uk

Introduction

As an intro to this series, it is worth starting with two previous sessions. There are more, but these are the best places to start.

The first is Session 10, called Asset Classes, or stuff you can invest in. As the title suggests, here I cover the main things you can make a portfolio out of. Shares, bonds, property, gold, commodities and all that jazz. That session will help you as we talk about these things in the coming sessions.

Then you should listen to Session 41 which is about building an investment portfolio and takes a very cursory look at Asset Allocation, Risk, Benchmarks and Costs. Finally, in that session I look at the fact that the biggest issue affecting investors is that we are usually our own worst enemy.

I want to pick up further on each of these over the next few weeks, starting today with some detail about Asset Allocation.

Ready? Let’s go…

Everything you need to KNOW

1 – There is no right way to invest

But I think there is a ‘best’ way for ordinary investors like you and me. Some will look to be very involved, but most will be more hands-off.

2 – Investing is more science than art, but it is a bit of both

There is a great deal that can be measured when it comes to investing, but so much more that can’t. Investors need to understand that in many cases, decisions come down to judgment calls rather than formulae.

3 – Investing is about controlling what you can control, and not worrying about the things you can’t

Unfortunately, you and I have no control over whether some nutcase in the middle east lobs a bomb at someone else. We don’t know when the legislative world will change either.

There is no sense in worrying over these things – doing so leads to paralysis

Instead, focus on what you can control. Things like:

- Cost

- Asset Allocation

- Tax

These will keep you plenty occupied, so don’t sweat the other stuff.

Everything you need to DO

1 – Identify some key pieces of information

- Timescale

- Risk

- Desired Outcome

2 – Decide on whether you will employ strategic or tactical asset allocation, or both.

- Strategic: long term, buy-and-hold, fire and forget

- Tactical: short-term, pivot based on market events or anticipated events

Anyone can do the former, very few can do the latter effectively

3 – Determine your asset allocation

Large part of this is down to your tolerance for risk and capacity for loss, which we’ll cover next week.

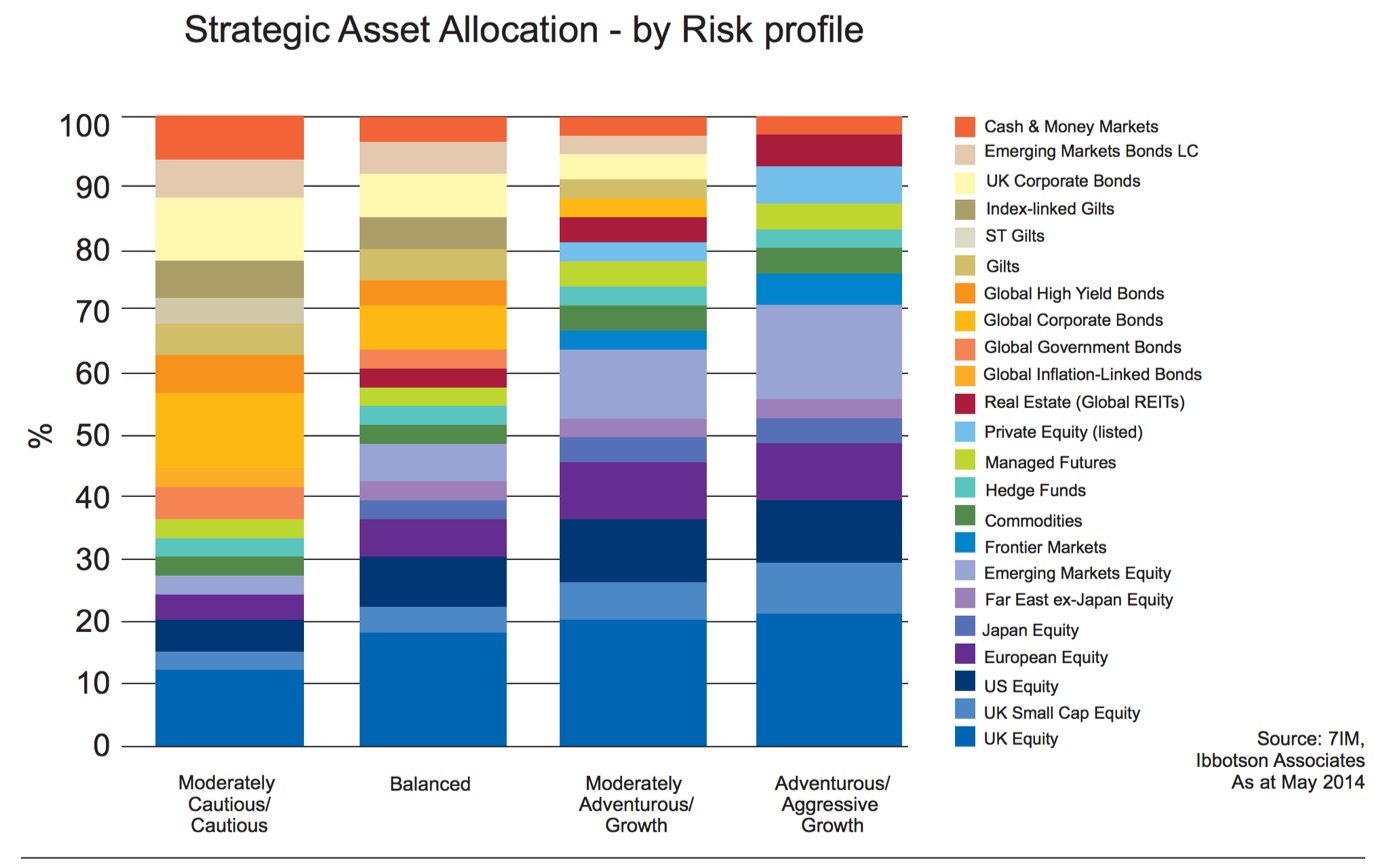

In the show I refer to this chart:

“Remember, the decision that will most affect your eventual returns is your division between bonds and equities.” – Monevator

- Populate the Asset Allocation

Once you have decided what your ideal split of assets should be, you need to actually buy some assets to fill it up!

Strongly advise against buying individual shares or bonds or whatever. They are expensive and create a paperwork mountain – just not necessary. Nobody does that anymore.

Instead you need to buy packaged funds of some kind. These come in two types: Active – fund managers making decisions to try and beat the market, and Passive – where the fund is aiming to track, not beat the market.

There’s a massive debate about this – both sides can be evangelical. Check back to Session 76 – How to win the loser’s game with Robin Powell, and maybe take the time to watch his excellent documentary about the fund management industry.

You will take your own view, but for me the answer is passive investing for the most part.

5 – Decide on a rebalancing strategy

It has been proven that any portfolio which is left to its own devices will underperform. It is also likely that the risk of any neglected portfolio will increase over time.

Regular reviews are necessary, but HOW do you review an investment portfolio? I covered this in Session 96.

Set up a rebalancing strategy. How often will you revert the portfolio back to the strategic allocation? Suggest quarterly – monthly too often and annual too infrequent. Can always do it in between quarters if necessary.

What does this entail? It means that if an asset class is going great guns and now represents a bigger slice of the pie than it did at outset, you need to sell enough of that fund and buy something which is performing less well.

Totally counterintuitive, but it might just save you from bad decisions. DECIDE to do this and stick to the decision.

Summary

So, to summarise:

1 – Identify key pieces of information – risk timescale, desired outcome

2 – Decide whether you are going to bother with tactical allocation or stick to a long-term strategic view

3 – Determine your asset allocation

4 – Populate the allocation

5 – Decide on a rebalancing strategy

That’ll do for this week I think. I’ll cover more about risk next week, which will help you as you are building your portfolios.

Don’t forget, a full transcript is available if you hit the button below:

Resources

Monevator – Asset Allocation types

Which? Money – Asset Allocation portfolios

FE Trustnet – Fund research

Hargreaves Lansdown – Index Tracker research

Direct Investment Platforms – Session 75

Reviews

Big thanks to MissMoneyPocket for her voicemail endorsement, and to WingNut2 and Mpeddddd, both in the US, for their reviews this week – much appreciated!

Don’t forget to go to meaningfulmoney.tv/iTunes or hit the big red button below to leave a review – it really helps!

Next Session Announcement

Next time we'll be talking about risk, in the context of our investing mini-series here. I’ll be looking about the kinds of risk you need to be aware of and trying to put some numbers on it. If you get chance, listen back to session 16 where I introduce the subject.

If you have a question on this subject, or any other financial query that you want answering here on the show, then the best way to do that is to leave me a voicemail at meaningfulmoney.tv/askpete

Leave a Reply